Canadian Dental Care Plan

What You Need to Know

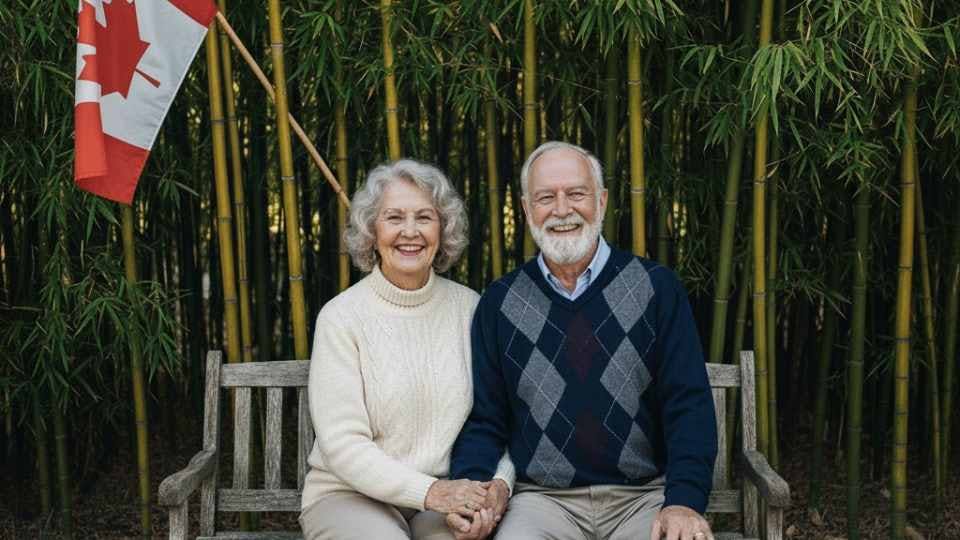

The Canadian Dental Care Plan (CDCP) is a federal program designed to make dental care more affordable for Canadians who don’t have private or employer-sponsored dental insurance. If your household income is under $90,000 a year and you don’t have access to workplace or private coverage, you may qualify for reduced-cost dental care.

If you or someone you love may be eligible, here’s what you need to know before your next visit to Bamboo Dental in Richmond Hill.

Are You Eligible for the CDCP? The Core Criteria

- No access to private dental insurance (cannot decline employer-sponsored coverage and still qualify).

- Adjusted Net Family Income (AFNI) under $90,000.

- Recognized as a Canadian resident for tax purposes by the CRA.

- Applications opening in phases, based on age and demographic groups.

Understanding "No Access" to Dental Insurance

The phrase “no access” means you are not entitled to enroll in a private or employer-sponsored plan. Declining workplace coverage makes you ineligible. Government programs (like NIHB or seniors’ benefits) don’t disqualify you. Health Spending Accounts (HSAs) do count as private coverage.

How Income Affects Coverage

The CDCP is income-tested. The lower your Adjusted Net Family Income (AFNI), the more coverage you receive. CRA verifies income annually through your tax return.

| Adjusted Family Net Income | CDCP Pays | You Pay (Co-payment) |

|---|---|---|

| Under $70,000 | 100% | 0% |

| $70,000–$79,999 | 60% | 40% |

| $80,000–$89,999 | 40% | 60% |

Note: Dentists may charge more than the CDCP fee guide. You are responsible for both co-payments and any extra charges.

What Treatments Are Included?

- Exams, X-rays, and preventive cleanings

- Fillings and root canals

- Tooth extractions

- Dentures

Not covered: crowns, bridges, implants, orthodontics, or cosmetic services (unless medically necessary and pre-approved). Since November 1, 2024, dental providers can request preauthorization for some complex services.

When Can You Apply?

- Seniors 65+ → Open since Dec 2023

- Adults with Disability Tax Credit → Open

- Children under 18 → Open

- Adults 55–64 → Opened May 1, 2025

- Adults 18–34 → Opened May 15, 2025

- Adults 35–54 → Opened May 29, 2025

⚠️ Applying doesn’t mean immediate coverage. Confirm your start date in your welcome letter or benefits card before booking treatment.

Canadian Resident for Tax Purposes: What It Means

Eligibility requires being recognized as a Canadian resident for tax purposes by CRA, which is not the same as simply living in Canada or having a health card.

This matters especially for newcomers, snowbirds, and Canadians working abroad. Your CRA tax residency determines eligibility and AFNI calculations.

Questions?

If you’re unsure about eligibility or estimating costs under the CDCP, contact Bamboo Dental in Richmond Hill. We’ll help guide you through your options.

Book Online

Bamboo Dental offers the ability to request your dentist appointments online. Schedule an appointment now!

Book Online